The energy market is changing, rapidly and drastically. Deregulation, decarbonization, decentralization and digitization pose new challenges, and it will be up to utilities to find solutions. To succeed, energy companies must become data companies rather than sellers of kilowatt hours, service providers rather than product suppliers. Other industries undergoing digitization and bringing companies like Airbnb, Uber and Amazon to the top may serve as a blueprint.

The Old Energy World

For decades, the energy market worked the same way: A centralized, fossil-fueled, analogous and highly regulated system provided electricity to customers, who neither had the means to produce energy themselves nor could they switch providers. The energy supplier, on the other hand, knew that large-scale investments like setting up power plants would pay off over their lifetime of several decades. However, this is changing.

Deregulation, Decarbonization, Decentralization and Digitization Change Everything

Deregulation brings competition

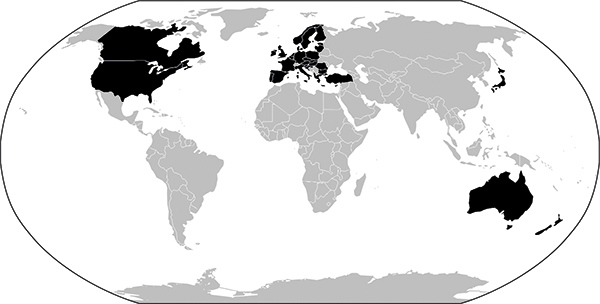

Starting with the United Kingdom under Margaret Thatcher in the late 1980s, many countries have begun to deregulate their electricity and natural gas industries. Among others, Japan, parts of the US and the huge majority of Europe, have liberalized or started to liberalize their markets. Today, 35 countries that make up 44 percent of the world’s energy consumption have begun deregulating their energy sectors.

This means competition for utilities: Competition in the wholesale market and competition for winning new customers, as well as keeping existing customers.

Figure 1: The countries that have deregulated or have started to dere gulate their energy markets are in black.

These markets make up 44% of the world’s energy consumption.

Graphic: GreenCom Networks. Data source: en-powered.com.

Decarbonization stirs up the wholesale market

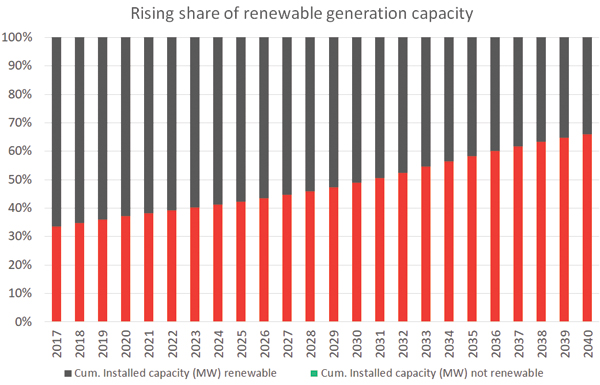

Adding to this competition of deregulated markets is the pressure of decarbonization and renewable energy sources on classical fossil power generation. Running old coal-fired or nuclear power plants does not guarantee solid revenue streams anymore – steady baseload cannot be achieved for central power plants with volatile renewables pushing into the market at any time. Also, with having almost zero marginal costs, renewables push many fossil-fueled plants to unprofitability – see merit order effect. (see Figure 2)

Currently, Bloomberg estimates, renewables provide more than 33 percent of the world’s installed electricity generation capacity. This percentage is growing and will reach almost 50 percent by 2030 and 66 percent by 2040. With these numbers, renewables are not just a mere green policy project but will determine how players in the energy market will be successful.

Figure 2: Forecast: Share of cumulated installed capacity worldwide.

Data: Bloomberg, BI SOLRG, long-term forecast, accessed 23.03.2018; Diagram: GreenCom Networks.

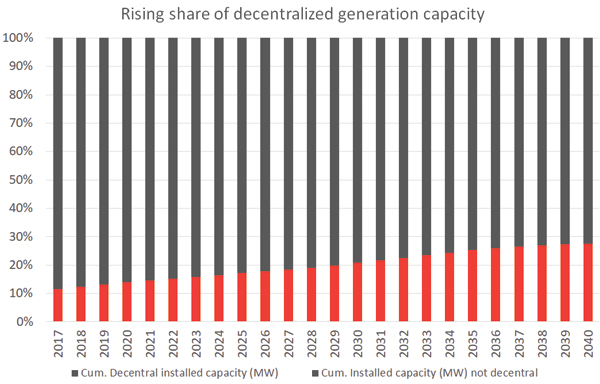

Decentralization eats market shares

Unfortunately for many utilities, the recent trend of decentralization diminishes an old and secure revenue stream: Selling kilowatt hours to customers. Take for example, Bill. Bill owns a house and has a solar PV system installed on his roof. He currently buys around 30 percent less electricity from the grid. Adding to that, Bill wants to increase his own consumption and doubles it by putting battery storage in his garage. However, Bill’s utility now has a customer that buys less energy and potentially causes problems by feeding in electricity whenever he does not need his own electricity, and his storage is full. (see Figure 3)

Currently, more than 10 percent of the installed generation capacity is decentralized – this includes on-shore windmills and Bill’s small-scale solar PV system from our example above. This number will increase nearly 30 percent by 2040, increasing the mentioned challenges of dwindling sales and a growing number of volatile and uncontrollable energy generation sources feeding into low voltage grids.

Digitization will disrupt the energy industry

We have seen what digitization can do to large and established industries: The music industry was forced online and into streaming with Spotify and Apple’s iTunes being the development pioneers; the movie industry struggles with competition from streaming services like Netflix offering a subscription model rather than a pay per movie fee, and telco companies have put large parts of their customer care online as well as established flat rate tariffs. Finally, retail stores are now sharing a market with Amazon, Alibaba and the like, while Airbnb is the largest hotel chain without owning a single bed.

What will digitization mean for the energy sector? The upcoming developments can be categorized into three sections with some already underway:

- To many, digitization means having the same processes in a computer, rather than on a stack of paper. Examples would be a chat function on the website instead of a hotline, electronic bills or functionalities like changing supplier, changing address, etc. on a web portal for customers. This is already happening but only constitutes a small part of what digitization can be.

- Still relying on established processes but automating them are several start-ups and digital companies. Comparison portals help customers to switch utilities fast and without any paperwork. A start-up in Germany makes switching completely automatic – customers just sign up and benefit from the switching bonus every year. The start-up gets a small part of the bonus.

- In the future though, we will see more business models that aim at changing whole processes. Peer-to-Peer trading for “prosumers” – meaning people who produce and consume at the same time – will offer homeowners with decentralized energy assets like Bill, the opportunity for better prices and more flexibility. Another example of changed processes could be the settlement of EV-charging payments via blockchain making the middleman obsolete.

Figure 3: Forecast: Share of cumulated installed capacity worldwide.

Data: Bloomberg, BI SOLRG, long-term forecast, accessed 23.03.2018; Diagram: GreenCom Networks

The Future Energy Market and its Challenges

Following these trends – deregulation, renewables, decentralization and digitization – four major challenges for the future energy market become clear:

- Meeting climate goals – generating power while reducing emissions remains a challenge.

- Integrating renewables – even more so, environmentally- friendly generation almost always means hard to handle generation, putting the grid under pressure and causing volatile prices.

- Keeping customers – with the next provider offering a bonus for switching with just a few clicks, utilities struggle with high churn rates – the longer the more. Also, prosumers may remain customers but buy less.

- Making money – uncertain revenue from generation, hard to integrate renewables and customers that switch or consume less. For utilities, it will become more difficult to make money with existing products.

Meeting Challenges – Services instead of Products, Data instead of Kilowatt Hours

To win in the new energy market, a paradigm shift will be necessary. It should not be about selling kilowatt hours or about products anymore. Rather, services and data will become vital resources. Or as one global professional services firm puts it, “Data is rapidly emerging as the most disruptive commodity in the 21st Century and an increasingly important opportunity for market differentiation among market actors.” 1

Meeting climate goals & integrating renewables

Decarbonization of energy generation takes the right means of generation and storage – solar PV and battery storages for instance. However, ramping up capacities of renewables alone will cause major grid problems and bring little revenue. Knowing how much energy will be produced or used at a given time though, will guarantee either cost savings or revenue if monetized. To do so, utilities will have to be able to collect, aggregate and interpret millions of data points to form actionable inputs for grid operators or to develop their own services.

Picture our example of Bill with his solar PV and battery storage. He is not buying much electricity anymore but is highly interested in a high self-consumption – with the right data his utility guarantees him 70 percent self-consumption. Bill, in return, agrees that his service provider may use up to 10 percent of his battery storage for ancillary services.

Empowering consumers to become prosumers will hurt utilities’ businesses at first. In the long run, however, providing services can generate new revenue streams besides an uncertain generation business.

Keeping customers

With comparison portals, electricity has become a pure commodity product. Even green tariffs can be compared, and suppliers can be switched within minutes. Once utilities start to offer unique services though, churn rates will drop.

Say, Bill has an EV, which he likes to charge once he gets home; however, he doesn’t like to use grid electricity for that. His utility offers a community to its customers, where energy can be shared freely among all members. The utility collects a small fee per month, whereas Bill can now share the surplus of his generation and use more energy in case his Solar PV and battery storage do not provide enough electricity.

Making money

Offering services based on data will cause one issue though: These business models are based on software platforms, meaning that they are highly scalable but only work if there are many customers integrated. A consolidation of the market is therefore very likely. In the end, there will be many utilities left with a shrinking generation, transmission and distribution business and several providers left dominating the market with their access to customers and the data they control – see Google, Amazon, Uber, Airbnb and Spotify in their industries.

Obstacles on the Way to the Utility of the Future

However, there are several obstacles in the way to becoming a data-driven, service-providing utility of the future:

- Scalability – although software platforms are highly scalable they may not scale over different markets with varying regulations or preferences of customers. This may be solved by adjusting, of course, but that may not be profitable for smaller markets.

- Laws and regulations – many countries have different laws and regulations to the point where even different states in the same country (the U.S., for example) have differing regulations. In many instances, business cases such as peer-to-peer-trading are currently not allowed.

- Young market – the energy industry is changing. No doubt about that. However, the new evolving decentralized market segments are still quite young and don’t offer the stability of mature markets.

- Deregulated markets only – digitization in regulated markets only brings efficiency gains; in deregulated markets, digitization brings a large variety of new services with significant value added.

- Interoperability among different manufacturers – currently, the Internet of Things is still in an early stage. There are numerous protocols and different manufacturers with devices not able to communicate in one common language. The new digital utility will integrate at least a majority of devices or set a standard itself.

Outlook

Although the energy market is fundamentally different from the music, movie or retail industries, basic learnings can be applied. In all cases, collecting, managing and monetizing data is a key factor for success. The utility of the future should become an energy data company. It will offer services based on data rather than solely kilowatt hours. It will not rely on revenue streams from generation assets, but rather on data that allows integration of renewables and unique services for customers. All this, however, should happen soon. As the global professional services company cited above cautions “energy companies and utilities have less than five years to reposition their companies, or risk ceding significant market share to new market entrants already targeting opportunities focused on the energy customer.2

Christian Feisst has more than 20 years of experience in the utility industry and across the entire value chain (Europe, US and ME). He was the founder and managing director for Smart Grid at Cisco Systems, spent 10 years working in the utility industry for the management consultancies A.T. Kearney as well as Booz Allen Hamilton and co-founded GreenCom Networks in 2011. He received his doctorate in business administration and is currently the CEO of GreenCom Networks.

Christian Feisst has more than 20 years of experience in the utility industry and across the entire value chain (Europe, US and ME). He was the founder and managing director for Smart Grid at Cisco Systems, spent 10 years working in the utility industry for the management consultancies A.T. Kearney as well as Booz Allen Hamilton and co-founded GreenCom Networks in 2011. He received his doctorate in business administration and is currently the CEO of GreenCom Networks.

References

1 Navigant, Energy Cloud 4.0 – Capturing Business Value through Disruptive Energy Platforms, p. 4.

(https://www.navigant.com/insights/energy/2018/energy-cloud-4)

2 Navigant, Energy Cloud 4.0 – Capturing Business Value through Disruptive Energy Platforms, p. 15

(https://www.navigant.com/insights/energy/2018/energy-cloud-4)