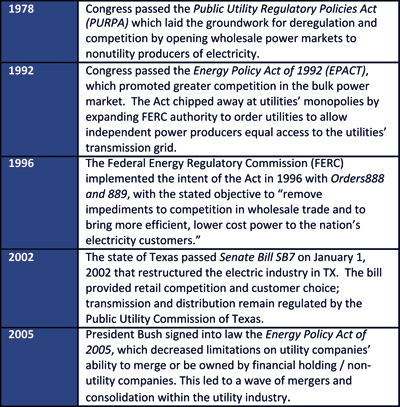

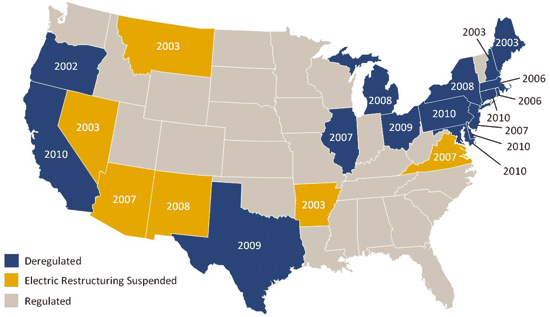

Although the retail power markets started to deregulate in 1978, the tiny state of Rhode Island was the first state to offer retail choice in 1997. The REP market has since quietly amassed scale as 15 states have joined the cause with much of the activity in the past five years. Texas proved to be a chief contributor to the success of the REP market when, in 2002, the state implemented a bill for retail competition for all customers served by investor-owned utilities. Furthermore, the Public Utility Commission of Texas approved new deregulation rules in 2004 and 2010, bringing the Texas market to $35 billion in competitive sales.

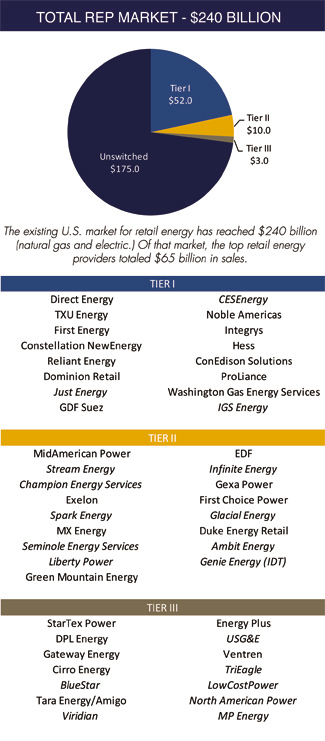

Over just the past ten years, the existing U.S. market for competitive electricity has grown an estimated $30 billion (now reaching the $180 billion plateau), and U.S. competitive power sales are only expected to increase, projecting as much as 10% in 2011. Few industries of this size have remained “under the radar” for so long – but that era has finally ended.

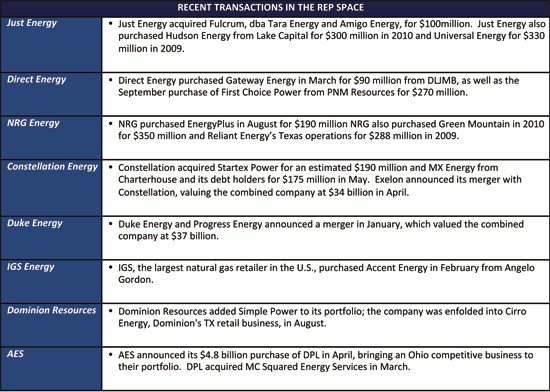

In 2011, 22 REP transactions were announced – nearly 40% of all REP transactions conducted over the past 10 years. To reference a few of the recently announced acquisitions:

History of U.S. Electricity Deregulation

To provide just a brief timeline of representative major events in the deregulation process:

Electricity Deregulated States and Most Recent Restructuring Activity

(Source: Stephens Inc.)

Factors Driving M&A

Today, REPs sell electricity to customers and handle customer service and billing; and compete for customers by offering pricing options, renewable energy options, added customer service benefits, or other incentives. The market is overcrowded with more than 200 retailers (116 in Texas alone), and there is a finite amount of capital and resources available to smaller providers. Approximately 50 REPs have eclipsed the $100 million revenue mark. Only two pure-play retail providers are publicly traded: Just Energy and Genie Energy (IDT Energy). Only 7 of the top 50 REPs are backed by private equity (mostly minority). However, this burgeoning industry is attracting the attention of strategic and financial investors alike.

Among the financial sponsors already in the REP space: Black Forest Ventures has a minority stake in TriEagle Energy; Champion Energy , a portfolio holding of Crane Capital; MVC Capital, Inc. holds US Gas & Electric Inc. and Plymouth Rock Energy; Energy Futures Holdings Corp (formerly TXU Energy) is owned (via leveraged buyout) by KKR, TPG and Goldman; Hunt Investments holds a minority investment in Ambit Energy; Platinum Capital is invested in Glacial Energy; and NGP Energy Capital is invested in Stream Energy.

To get financial backing requires more than a good sales pitch. Although some independent REPs (not affiliated with incumbent generation) are drawing $300-900 million per year in sales, they find it difficult to raise capital without demonstrable evidence of sustainable competitive advantages:

- Scale and expanded footprint

- Unique brand and reflective reputation

- Portfolio of creditworthy customers on fixed-priced contracts or higher margin variable contracts

- Product differentiation and diversification

- Proprietary technology along customer acquisition, service and billing

- Niche marketing approach such as affinity programs, network marketing and aggregation

- Smart grid technology adoption (automation, smart metering, demand response, dynamic pricing)

Such differentiating qualities also extend to the buyout process, as various bidders across the power industry are actively pursuing opportunities. Companies with defendable growth prospects and sticky customer platforms are positioning themselves for sale, exacting attractive EBITDA multiples. Consider NRG’s acquisition of Energy Plus, paying close to 8x EBITDA. Energy Plus capitalized on its unique affinity marketing channel – airline miles for power purchases. Note that Just Energy has consistently traded at a double-digit EBITDA multiple, leaving plenty of room for private-to-public arbitrage.

So who are the bidders in this highly fractured REP marketplace?

- Larger independent retail energy providers with sufficient scale or financial backing are logical buyers, as they seek to increase market coverage, gain economies of scale and take out competitors Examples include Just Energy, Liberty Power, Champion Energy, Spark Energy and IGS Energy. More often, their interest lies in buying up the books of business of smaller players, expanding their footprint and product offerings. One takeaway is that four independent REPs (Glacial, Spark, Liberty and Just) are licensed and operating in all 16 deregulated states. Only Constellation and Dominion, among the incumbents, are active in more than 10 states.

The acquisition of the Abacus book by Spark Energy is an example of something that the bureaucracy of an incumbent would not allow. The book of 6,200 customers was transferred and paid for over a weekend. Just Energy’s acquisition of Fulcrum followed a similar – yet slightly longer – timeline.

There was no process and no other bidders. - Since independent retailers came to the market, giving consumers more flexibility and choice in providers, incumbent utilities have lost a large percentage of their retail customer base. Take TXU, the largest incumbent in Texas, which saw its residential customer count decline from 2.5 million in 2002 when the market opened to 1.7 million this year, a 30% drop. Regulated utilities seeking to recapture customers have been active acquirers . NRG, Constellation and Direct have all made multiple REP acquisitions. In fact, 18 of the 19 publicly traded utilities that have REP divisions have made at least one REP acquisition. Incumbents are starting to realize that their rate-based strategies aren’t applicable in a market won via creative marketing. Most utilities have kept their prizes as separate divisions to preserve this edge.

As listed above, Constellation Energy picked up MX Energy and StarTex Power, helping Constellation expand its footprint and adding to its retail book. Benefits of these two deals also included increased scale and scope across the value chain, strength in market position to exceed one million mass market customers and new geographic reach.

As referenced above, NRG acquired Energy Plus. The attraction was obvious: Energy Plus’ channel as the largest affinity marketer with previously successful credit card marketing companies provides credibility to their model; furthermore, they benefit from a rapidly growing network of almost 100 industry-leading partners and associations. The deal increases NRG’s scale in the Northeast – over 90% of Energy Plus customers are in that region; and strengthens NRG’s retail base by adding a high growth platform to match their generation in the region. - Integrated energy companies could leverage their existing strategic relationships. To date, the likes of BP and Shell have decided to stay in the wholesale business as they know commodities rather than customers. This trend is unlikely to change as wholesalers see plenty of business in supplying the retailers. The market for bank financing is non-existent for retailers without generations assets, save Spark Energy, IGS Energy and Just Energy, all three of which have syndicated credit facilities. Retailers in turn, rely on supply credit and sleeve arrangements to procure the commodity. As margins continue to compress at the wholesale level we may see some new strategies.

Hess is relatively integrated from wholesale to retail, although they continue to operate exclusively in the Northeast. As a leader in international wholesale energy markets, EDF Trading is an example of a forward thinker – they made a minority investment in their largest wholesale customer, Champion Energy. EDF is also supplying large commercial customers at the retail level. Twin Eagle is another wholesaler to watch, with the possibility of expanding their services beyond wholesale and into retail. - Leading energy services / efficiency companies are closely monitoring the REP model. They should be interested, but they are cautious about the commodity risk. Find a way to transfer that risk and preserve the customer relationship, and this combination will transform the sector.

Leading ESCOs that should be taking a closer look would include Silver Springs, Comverge, Enernoc and Ameresco. Blue Star Energy is an independent REP that has already integrated energy efficiency consulting into their approach – they were recently acquired by AEP. Large incumbents such as FirstEnergy and ConEdison have pushed this connection for some time now. The energy service platform is yet another way to retain customers. Home automation, demand response and other energy technology providers may consider pairing up with REPs to offer this integrated offering. - With all of that said, the future of the REP sector lies in the past. Telecom acquirors have yet to fully appreciate what a REP really is – a customer acquisition and retention machine. Now think about bundled services. Now think about the size of your electric bill versus your cell phone bill. It’s coming, deregulation and eventual consolidation. Only this time, the independents do not have to rent capacity from the incumbents. The playing field is level.

IDT Telecom was the first telecom company to enter the retail electric sector. They are now the largest independent REP in NY and the first U.S. listed REP. They were spun off from IDT on October 31, 2011 under the name Genie Energy. Paetec Energy, one of the early telecom players in retail energy, was acquired by Windstream for $2.4 billion in August of last year.

Cincinnati Bell and Viridian are yet another twist. Verizon Power? AT&T Energy? Someday. Both are already offering home automation and energy management programs. Find a way to transfer the commodity price risk back to the wholesalers and you have a game changer.

Source: Stephens Inc.

The existing U.S. market for retail energy (natural gas and electric)

has reached $240 billion. Of that market, the top retail energy providers

totaled $65 billion in sales. [Please note that this listing is purely

representative, and does not purport to be a complete reference to

all REPs. Italics represent independent REP providers.]

Conclusion

Today, less than 20% of total U.S. power customers have switched (up from less than 10% a few years prior), but nearly half of customers in deregulated markets have switched, and this trend is continuing. Witnessing the success of the Texas model, states such as NY, PA, GA, CA, MI, OH, CT, and DE are following suit. As more states deregulate power markets, opportunities exist for REP entrants to take share from the utility incumbents.

This creates a confluence of factors leading to more industry consolidation in the near future. The winners and losers have yet to be identified, but the level of M&A activity suggests that a transformation of the deregulated power markets is underway.

About the Author

Justin L. Courtney is a senior vice president at Stephens Inc., where he provides M&A, capital raising and supply financing services in the Power and Resource Solutions group. He is responsible for subsector coverage of retail energy, energy efficiency and energy infrastructure. Stephens Inc. is a full-service investment banking firm headquartered in Little Rock, AR, with offices across the country. For further information, contact Justin in the firm’s Dallas office at (214) 258-2748 or via e-mail at justin.courtney@stephens.com.

Justin L. Courtney is a senior vice president at Stephens Inc., where he provides M&A, capital raising and supply financing services in the Power and Resource Solutions group. He is responsible for subsector coverage of retail energy, energy efficiency and energy infrastructure. Stephens Inc. is a full-service investment banking firm headquartered in Little Rock, AR, with offices across the country. For further information, contact Justin in the firm’s Dallas office at (214) 258-2748 or via e-mail at justin.courtney@stephens.com.

This article has been prepared solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the securities, markets or developments referred to in the material. Information included in the article was obtained from internal and external sources, which we consider reliable, but we have not independently verified such information and do not guarantee that it is accurate or complete. Such information is believed to be accurate on the date of issuance of the article, and all expressions of opinion apply on the date of issuance of the article. No subsequent publication or distribution of this article shall mean or imply that any such information or opinion remains current at any time after the stated date of the article. We do not undertake to advice you of any changes in any such information or opinion. Our employees, officers, directors and/or affiliations may from time to time have a long or short position in the securities mentioned an may sell or buy such securities. The author principally responsible for preparation of this article has received compensation that is based upon, among other factors, Stephens Inc.’s investment banking revenues. Additional information is available upon request. Stephens Inc., Member NYSE, SIPC.