Introduction

The new, highly-secure automated Demand Response (DR) platform, OpenADR 2.0b, opens up the next generation of markets for DR and energy market program participants. Recent OpenADR 2.0b pilots focused on Ancillary Services, including Synchronous Reserve and Regulation, at PJM Interconnection, LLC eclipses historical viewpoints that DR may not be relied upon to deliver the easily measured and verified performance required in the small intervals necessary for program participants to receive best treatment valuation and market incentives. The pilots have shown that DR resources show great promise as a provider of ancillary services.

Changing supply paradigm and new regulations requires new resources!

EPA driven coal plant shuttering, nuclear energy facility closures, shale production, and related energy market price reductions all coupled with unpredictable climate create the need for critical planning by grid operators to meet ever growing and changing energy supply needs. The OpenADR 2.0b pilots successfully demonstrate that proactive demand and load management may be relied upon as an efficient and cost effective method of meeting today’s changing supply, regulation and price reductions.

What is OpenADR 2.0b?

OpenADR is a standardized method for electricity providers and system operators to communicate DR signals with each other and with their customers using a common language over any existing secure IP-based communications network, such as the Internet. It is designed for sophisticated devices supporting most DR services and markets, with flexible capabilities for generating past, current, and future data reports.

Characteristics of the ‘New DR’

‘New’ DR programs are more granular in several ways:

- Some existing programs are locational forms of Emergency DR Programs. These programs, enabled by GIS systems, permit a utility to ‘turn-off’ participants located on an overloaded feeder line, rather than turning off program participants throughout their operating area.

- New DR programs, enabled by the new OpenADR 2.0b autoDR standard, enables programs to be called piecemeal or incrementally – some examples include:

- A shed request might be for twenty percent (20%) against a committed shed level

- Setting a thermostat controlling a HVAC up three (3) degrees on a hot day

- Dispatching participants in certain ancillary services programs, described in more detail, below.

In each use case listed above, the ‘new’ DR programs provide participants new monetization incentives too, often at minimal inconvenience to the facility, while enabling continued evolution of grid reliability and stability. The protocol pilots have successfully demonstrated the ability to make demand side load available in an efficient and cost effective manner for a variety of markets such as:

- Capacity

- Energy

And further enable such ancillary services as:

- Regulation

- Synchronous Reserves

Over the past year, the company participated in and led trials of the use of OpenADR 2.0b in certain ancillary services programs. The results and ‘lessons learned’ from that trial are discussed in the rest of this article.

2013 to 2014 OpenADR 2.0b Pilot at PJM Interconnection, LLC

IPKeys announced in April 2014 the successful conclusion of multi-phase pilots at PJM Interconnection over the course of the last year for Ancillary Services (Synchronous Reserve and Regulation) utilizing its OpenADR 2.0b certified Energy Interop Server & System server and end point hardware. The pilot participants – Walmart, PJM, Lawrence Berkley National Laboratory (Berkeley Lab), and Schneider Electric – succeeded in showing the technological feasibility of using the OpenADR 2.0b profile in the field for ancillary services and regulation signaling.

Walmart provided a signaling test bed at one of its 24x7 Super Centers in Pennsylvania as part of the pilot’s synchronous reserve (SR) phase. This involved translating the PJM SR web service signal into an appropriate OpenADR 2.0b service message to successfully control a series of lighting and HVAC loads via Walmart’s Building Management System (BMS) solution.

According to the author;

This highly secure technology enables energy consumers such as Walmart to receive actionable open standard and machine interoperable market signals directly from ISO’s and begin the process of automating participation in ancillary services and other rapid response markets, reduces risks associated with the wholesale market and empowers participants to focus on realizing value.

In the regulation phase of the pilot program, funded by the U.S. Department of Energy’s Office of Electricity Delivery and Energy Reliability, Schneider Electric provided a signaling test bed in its variable frequency drive (VFD) laboratory in Raleigh, NC. Work in this project phase concerned translation of the PJM regulation signal into the appropriate OpenADR 2.0b web service messages. Schneider Electric also monitored its ability to track both the various PJM test regulation signals as well as its ability to convey the regulation signal via both XMPP and HTTP Internet protocols.

“We have demonstrated that it is possible to perform four second regulation using secure web services – this capability dramatically reduces the cost and complexity barriers for loads to participate in regulation markets when compared to dedicated DNP3 or ICCP links,” said Jim Boch, Senior Electrical Engineer and EISS™ product manager.

“The team’s end-to-end demonstration has shown that the open signaling architecture is fast enough to satisfy the timing requirements of PJM’s ancillary services,” said Jason MacDonald, Senior Scientific Engineering Associate at Berkeley Lab. “This demonstration shows how easily resources can connect to various markets when they are enabled with OpenADR clients.”

“PJM is pleased to have participated in this innovative pilot project for automated demand response,” said Sarah Burlew, Manager of Applied Solutions. “For PJM, one of the key elements of this project is its incorporation of secure communications, which is critical to protecting and maintaining a reliable grid.”

The technical setup and business outcomes of the pilots is described in the sections following, below.

Technical Description – OpenADR 2.0b Pilot at PJM Interconnection, LLC1

Synchronous Reserve Test Setup

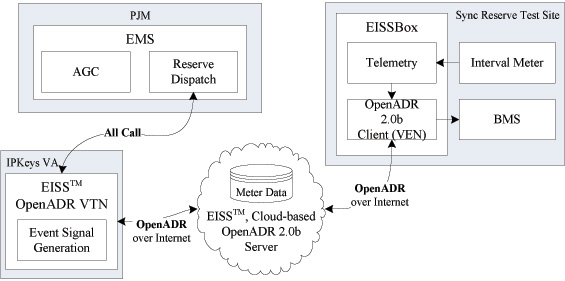

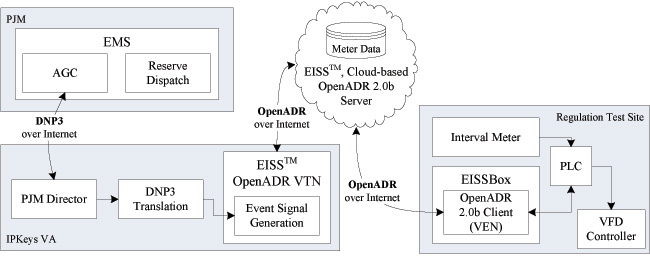

The synchronous reserves tests were performed in October 2013 and included the company’s end-to-end tests in April 2014. The participating retail store was a Walmart in Pennsylvania. Roof top air conditioning units and interior lighting were shed in response to a test reserves call from PJM. The signals were comprised of instructions to shed different levels of load corresponding to the shedable load of the two subsystems under control. The signaling architecture is shown in Figure 1.

Figure 1: Synchronous Reserve Test Setup

Frequency Regulation Test Setup

The frequency regulation tests were performed with a VFD-retrofitted heat pump supply fan that cools a small laboratory at a Schneider Electric facility in North Carolina. The VFD can drive a previously constant volume fan within a range of ± 5 hertz in 0.5 Hz steps. To run the tests, normalized regulation signals were sent via OpenADR 2.0b and translated into the frequency range in which the device operates. In this scenario, the model for translating the frequency range resides in the EISSBox, although for scalability the control logic should be migrated to the PLC or ultimately a BMS for a true deployment in a commercial building. Additionally, the controller is open loop with respect to its objective, power.

Figure 2: Frequency Regulation Test Setup

(click to enlarge)

Business Impacts & Market Value Capabilities that OpenADR 2.0b Provides

***Synchronous Reserves appears to be a better option than most traditional DR programs as long as the building management system is capable of receiving a response request and shedding load within the ten minutes required.

***Regulation Participation in PJM markets is valuable for resources that have the control and metering capability to perform two second regulation whereby the signal is sent every two seconds. There is a ten second lag before response is required.

PJM splits its Synchronous Reserve Market into two tiers:

Tier 1 reserves are those that result from economically dispatching generation at levels less than their rated capacity. Tier 1 resources are not paid for their capacity, as they have no lost opportunity cost; however, they receive a premium on the price of energy they supply during reserve events.

Tier 2 resources are those resources that are dispatched for energy at a sub-optimal level in order to maintain adequate reserve in the system. These resources do have a lost opportunity for supplying energy and are thus paid a capacity price that is equivalent to the largest opportunity cost payment of all such resources, termed the market clearing price (MCP).

Demand Response is considered a Tier 2 resource, although it does not have an opportunity cost in the same way a generator might. Thus a DR resource relies on other, more traditional Tier 2 resources to set the market clearing price for synchronous reserves.

To get a sense of the range of prices for synchronous reserve, analysis of historical data may be useful.

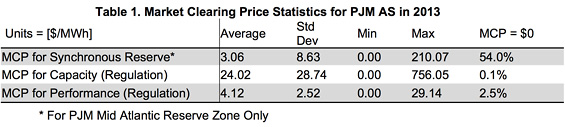

Table 1 displays market clearing price statistics for synchronous reserves in PJM’s Mid Atlantic Reserve Zone in 2013 taken from publicly available data.2

The data suggests that if a demand response resource were available for all hours of a month, then the resource may expect to capture $2.24 per kW of DR capacity per month. However, the spinning reserve MCP is the most uncertain of the Ancillary Services (AS) prices in PJM, as evidenced by the very large standard deviation and the fact that 54 percent of hours recorded a market clearing price of zero. A more thorough analysis would consider only the value during the hours in which a DR resource is available to shed load, such as during business hours for lighting and HVAC in a retail store. This value is also only inclusive of the capacity value of providing SR, this does not include the value of the energy provided when called, which is paid at the locational marginal price plus $0.05/kWh.

In addition to the value available for SR:

Table 1 also contains data pertaining to the value of regulation during 2013. The average market clearing price suggests that the capacity value to a resource that can provide regulation for all hours of the day is approximately $17.5/kW-mo. This is considerably higher than the value of SR and the clearing price has less uncertainty with very few hours in the year clearing at $0/MWh. Additionally, resources earn revenue from their performance each hour, which is tied to the market clearing price for performance. The nearly order of magnitude difference in the value of regulation suggests that resources that have the control and metering capability should give significant consideration to participation in regulation in PJM’s markets.

Energy Impacts: Frequency and Duration of Events

A common concern of potential demand response participants in ancillary services markets is what impact participation will have on their operations. One way to examine this would be to consider the frequency or probability to be called in any hour as well as the duration of response required.

In SR, participants who have bid into the market are paid to stand by. Historical SR data from the last five years suggest that on average, PJM makes SR calls in their Reliability First Corporation Reserve Zone an average of 31 times per year, with a range of 19 to 39 reserve deployments per year.3 This corresponds to a roughly 0.4 percent probability that awarded capacity will be called in any given hour. Additionally, the average duration of events in these five years was 11 minutes and 18 seconds, with a standard deviation of the sample around 7 minutes. The minimum duration was 4 minutes and the maximum was 1 hour and 8 minutes. These statistics suggests that 80 percent of reserve calls in PJM are less than 20 minutes in length.

This makes the SR market in PJM look much less impactful than traditional emergency demand response programs that typically have 2 to 4 hour response durations and can be called for upwards of 100 hours per year.4 In terms of impact to building operations, Synchronous Reserve appears to be a better option than most traditional DR programs as long as the building management system is capable of receiving a response request and shedding load within the ten minutes required – capabilities that OpenADR 2.0b provides.

Conclusion

Demand response resources show great promise as a provider of ancillary services. The present work and pilots describes a battery of tests that show adequate capability of HVAC and lighting loads to provide ancillary services in the PJM Interconnection territory. The synchronous reserve test displayed noticeable load sheds for both the lighting system and the HVAC system within a few minutes of receiving the signal. For both load drops, the response was much faster than the ten minutes required by the synchronous reserve product definition.

About the Authors

Robert Nawy is the Managing Director & Chief Financial Officer of IPKeys. He has served in these roles since the inception of the company 2005 and oversees the development and delivery of Municipal and Smart Grid products and services. He currently serves on the Boards of Directors of the Open Automated Demand Response (OpenADR) Alliance and the Advanced Energy Management Alliance (AEMA).

Robert Nawy is the Managing Director & Chief Financial Officer of IPKeys. He has served in these roles since the inception of the company 2005 and oversees the development and delivery of Municipal and Smart Grid products and services. He currently serves on the Boards of Directors of the Open Automated Demand Response (OpenADR) Alliance and the Advanced Energy Management Alliance (AEMA).

Mr. Nawy also served as CFO & VP Business Development of Exenet, the first Application Infrastructure Provider (‘AIP’) and as CFO of Maden Technologies, a DoD focused high technology services provider.

Additionally, with an MBA, CPA and Civil Engineering credentials from Rutgers University, Mr. Nawy oversees all internal Corporate Services functions of IPKeys and has successful capital raising, merger and acquisitions, strategic partnership and solution implementation and delivery experience in evolving IP technologies in the commercial sector. His previous assignments include CFO at Stronghold Technologies, a publicly held technology company that created the first wireless CRM solution for the automobile retail industry.

Jason MacDonald, a Senior Scientific Engineering Associate at Lawrence Berkeley National Laboratory, has focused his career in distributed energy resources. As a member of the Grid Integration Group in the Environmental Energy Technologies Division at LBNL, Jason researches fast, automated demand response for bidding into bulk power system ancillary service markets. This work includes analyses of market and policy barriers to DR’s market entry into ISO/RTO markets, the development of mathematical models for demand response availability and pilots to test control paradigms for resource aggregation of thermostatically controlled loads and PEVs for AS participation.

Jason MacDonald, a Senior Scientific Engineering Associate at Lawrence Berkeley National Laboratory, has focused his career in distributed energy resources. As a member of the Grid Integration Group in the Environmental Energy Technologies Division at LBNL, Jason researches fast, automated demand response for bidding into bulk power system ancillary service markets. This work includes analyses of market and policy barriers to DR’s market entry into ISO/RTO markets, the development of mathematical models for demand response availability and pilots to test control paradigms for resource aggregation of thermostatically controlled loads and PEVs for AS participation.

Prior to joining LBNL, he pursued his graduate work in Mechanical Engineering and Sustainable Systems in the University of Michigan’s Engineering Sustainable Systems dual degree program. As a student researcher, Jason examined the electricity consumption profile, fleet marginal electricity demand and environmental impacts of PEVs. He has held positions as a system engineer for a photovoltaic integrator in Southern California, and as a systems integration engineer on the Chevy Volt powertrain at General Motors.

References

1 Content of this section is based on an early draft of Jason McDonald, et al. Commercial Building Loads Providing Ancillary Services in PJM. Lawrence Berkeley National Laboratory, (March, 2013):

2 PJM. Preliminary Billing Reports p Ancillary Services Market data. http://www.pjm.com/markets-and-operations/market-settlements/preliminary-billing-reports.aspx

3 PJM. Historical Synchronized Reserve Events. http://www.pjm. com/~/media/markets-ops/ancillary/historical-spin-events.ashx

4 Cappers, P., A. Mills, C. Goldman, R. Wiser, J.H. Eto. 2012. “An assessment of the role mass market demand response could play in contributing to the management of variable generation integration issues.” Energy Policy 48: 420-429